반응형

- MCQ-01636: Except for interest from state and local government bonds, interest income is fully taxable. 잊지 말자!

- MCQ-01620: 2018년 이전이니까 Paying spouse는 deduct 가능하고 receiving spouse는 income에 넣었어야 하는데, 대신 receiving spouse한테 가는 돈 중에 "child support"에 해당하는 부분은 신구 법률 관계없이 무조건 adjust-deduct from payer / add to receiver's income된 적이 없음!!! 애가 성인이 되면 20%만큼 줄이겠다는건 20%가 child support에 해당하는 거라고 봐야 함.

- MCQ-05279: Accrual-basis taxpayer...헐...ㅋㅋㅋ또 만나냐 accrual basis T^T an accruable expense is the servies have been received/performed but have not been paid for by the end of the reporting period

- MCQ-01840: A cash basis taxpayer should report gross income for the year in which income is either actually or constructively received, whether in cash or in property

- MCQ-08705: In case of noncash income, the amount of income to be rpoerted is the FMV of the property or service "received." The FMV of any services "rendered" is irrelevant.

- MCQ-06153: Gross income does not include inheritances

- MCQ-14628:

- If you have an overall capital loss for the year, you can deduct up to $3,000 of its value from your taxable income.

- If your overall capital loss is more than $3,000, you can carry the remainder forward to future tax years.

- MCQ-15965: Under a nonaccountable plan (i.e. expenses are not reported to the employer), any amounts received by an employee from the employer must be reported by the employer as part of wages on the employee's W-2 for the year (and subject to income tax withholding requirements). The gross amount received is reported as income.

- MCQ-01387: Remeber, tax is often paid by the person giving the gift or the estate at death.

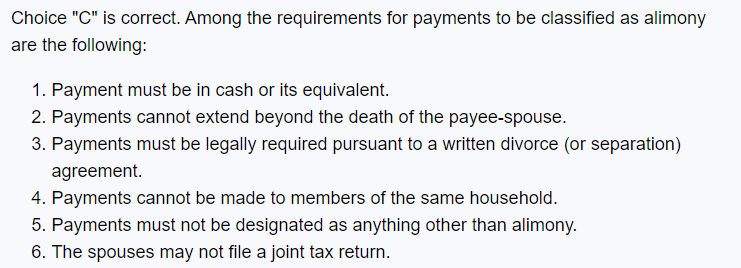

- MCQ-14627

- MCQ-15814:A loss on the sale of a personal residence is a non-deductible personal loss, not a capital loss. 내가 살던 집 주거용을 팔아서 생긴 손실은 빼주지않음. 3,000 맥스 생각할 것도 없음.

반응형

'Regulation > US Tax' 카테고리의 다른 글

| AICPA Released Questions -2022 (0) | 2024.02.10 |

|---|---|

| R1 - M5 - Itemized Deductions 오답 노트 (1) | 2024.02.05 |

| R1 - M2 중 IRA 에 대해 알아봅시다 (1) | 2024.01.30 |

| R1 - M1 - FIling Requirements and Filing Status 오답노트 (0) | 2024.01.29 |

| US Income Tax Form - 모르는 용어 정리 (0) | 2024.01.03 |

댓글